Private 5G networks play a crucial role in the TLC market, and many companies resort to them as they represent an innovative technological solution to meet their connectivity requests and implement their daily activities. More safety, more privacy, and a faster and safer connection: these are the key factors to be taken into consideration while opting for 5G private networks for companies’ communication. Despite the well-known benefits and solutions offered by in-house companies, private networks are still not used by Italian companies: in many EU countries, 5G networks have become the standard while Italy is still reluctant to using them. That’s the reason why the Government should allocate more money to encourage companies using these new technologies.

5G private networks: a market ready to get off the ground expect for Italy.

Private Networks are among the most powerful 5G solutions to implement TLC industry. However, in comparison to the major European economies, the Italian market is still struggling to launch its strategy; nonetheless, due to the incredible amount of benefits that companies perceive from these solutions, like “a greater control and network configuration, higher resources and operational efficiency, higher resilience, privacy and safety”, 5G networks are being implemented. Even if companies are aware of the development and benefits of this technology, as of last September, 94 private 5G networks have been developed in Europe but only four of them are currently being used.

According to a recent study conducted by the 5G & Beyond Observatory of School of Management at Politecnico di Milano, the turnover at European level could reach 1.7 billion euros within the next three years, with Italy raking fourth in Europe and registering 10% of this value. The most optimistic and favorable scenario foresees the field exceeding 2 billion euros by the end of 2026, but only if more favorable circumstances occur, like the proliferation of autonomous mobility projects or the success of vertical applications such as real-time tracking of goods or production assets in remote industrial sites. Shouldn’t it happen, the market value may not exceed the 1 billion marks.

Why do companies resort to private networks?

Why does a company decide to resort to this kind of private network? It not only depends on connectivity performance but also on company’s needs: 5G results, in terms of stability of complex devices, can’t be met by solely using the public network. In these cases, the ideal solution is represented by private networks which are specifically deployed for companies to smooth and optimize their policies and procedures while, at the same time, meet the needs of the business in terms of performance, connectivity, and safety which would, then, be impossible to achieve with a public network.

There are three main factors that encourage companies to opt for this solution: first, knowing that they can count on a faster and reliable network connection in places with challenging conditions or with limited/non-existing connection; secondly, being able to fully manage the network when setting up public networks and/or implementing the network itself; thirdly, being able to resort to a more powerful network capable of supporting challenging applications.

Main benefits of private networks according to a study by Ericsson

According to Endeavor Business Intelligence and IndustryWeek study conducted by Ericsson, it has emerged that out of 100 manufacturing companies 30% are already using private networks on mobile technology, while 8% is planning to invest in such networks within the next 12-24 months. According to interviewed people, the greatest benefits would result in a greater connection, greater network performance, speed, and greater reliability.

Additional benefits include a greater safety compared to Wi-Fi based private networks, as the former uses specific radio frequencies and can be easily integrated with companies’ pertinent security infrastructures. According to another study conducted in 2020 by Ericsson in partnership with Hexagon and Arthur D. Little, and analyzing 5 cases studies about European medium-sized companies in the automotive supply chain, it emerged that autonomous mobile robots (AMR) represent the greatest added value to manufacturers.

Indeed, what is necessary to enable the movement of these robots for production related tasks, like transporting goods, is having a highly reliable connection with law latency. This way, AMR can maneuver machineries in a safer way, even in a work environment with many workers and other devices. These robots can also handle goods in a manner that they decrease production scarps by 30%, thereby increasing profits and environmental sustainability. With this respect, the return of investment (ROI) should be around 50% in the next five years.

Significant results about collaborative robots (Cobot) emerged in the same study: specifically, these robots take advantage of 5G private networks making manufacturers daily work easier, like drilling, assembly activities, and products quality check, satisfying customers’ needs. In this case the ROI would be around 44% in the next five years. Similarly, monitoring company’s assets allow, on the one hand, the gathering of data from machineries and, on the other hand, the timely issuance of alerts for maintenance intervention. This dual function reduces costs associated with unpredictable downtime. The case study reports a ROI at 151% in the next five years.

Even the use of the so-called digital twins, using safe, speed and manageable private networks infrastructures, encompasses lots of benefits for manufacturing companies, like being able to consider potential scenarios and test operational activities without physically modifying an object, component, or machinery. In this case, the ROI would be around 28% in the next five years. Lastly, the study concludes that, when using all five mentioned cases simultaneously, they can reach a ROI of 116%.

The worldwide spread of private networks

According to figures from the Global Mobile Suppliers Association (GSA), 1.279 private networks were globally implemented during the 2024 third quarter, with an increase of 34% compared to the one of 2022 and to the third quarter of 2021 which was about 142.2%. Even if Europe is not at the forefront in this field, Italy is increasingly adopting a more forward-thinking approach. According to the latest figures from the European 5G Observatory dating back September 2023, 94 companies in 21 EU Member States, like Germany (20) and France (13), have already implemented private networks, while in Italy only four of them are being used.

From a sectoral point of view, the analysis reveals a clear prevalence of the industry, which accounts for 50 cases, while in second place is the transportation sector with 20 cases only. The most part of these Italian cases refer to the business, like the partnership between WindTre Business and Terminal Psa Italy in Genoa, which aims to develop a Smart Port in Genoa, using 5G private network, and another one in the education and research field.

Italian model

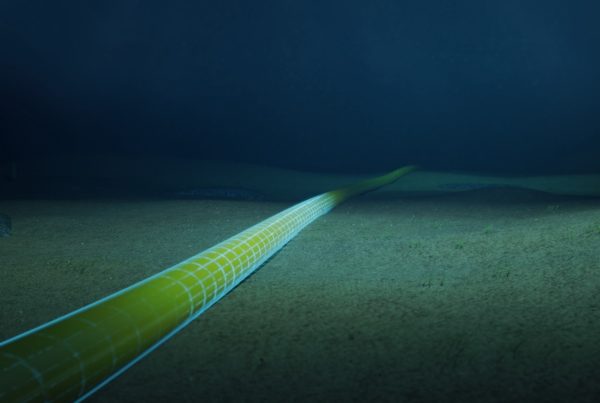

5G private networks are needed to implement companies’ productivity and safety; unfortunately, Italy is left behind compared to other European countries. Nevertheless, some projects resorting to this technology are being developed in our country, like Vodafone Business and Snam which have recently agreed on fostering 5G to monitoring gas storage and distribution plant activities throughout the national territory. The goal is to create a hybrid 5G private infrastructure, meaning a network which complements Vodafone’s one, to connect to 23 Snam facilities by the next 18 months.

WindTre business in Genoa

Another noteworthy initiative is the one about the collaboration between WindTre Business and Terminal Psa Italy of Genoa Pra which aims to create a safe, high-performing, and expandable Smart Port in Genoa. Moreover, the project aims to become a role model to be used in other logistics and industrial environments.

The example of Vodafone business and Porsche

Last December, Vodafone Business and Porsche announced the construction of 5G hybrid private network, covering an area of 7 square kilometers in Puglia, specifically at the Nardò Technical Center (NTC) of Porsche. The goal of the project is to let automotive industry use a real-time communication network which, by leveraging the combination of private and public components, reduces latency and widen bandwidths.

Vodafone PI and Palermo University

A forward-thinking partnership between public and private sector, specifically between Vodafone Italia and Universita’ degli Studi di Palermo. On February 14th they both announced the implementation of a private hybrid 5G network in the framework of 5G 4 A Smart Sicilian Academic Campus project. More specifically, around 4M euros from the EU “Connecting Europe Facility” funding plan were allocated; moreover, with the support of the Ministry of Enterprises, Made in Italy and Sicily region, the project will provide – within the next three years – an ad hoc 5G coverage for UniPa, including the campus in Trapani and the University Hospital Paolo Giaccone. The main goal is to create both ten “augmented classes,” each of them equipped with Extended Reality (XR) devices, and mirroring systems providing an immersive and remote learning experience.

Mobile private network for power grid: Terna-WindTre platform is about to kick off

The partnership between WindTre and Terna has been recently announced, with the latter choosing a mobile private WindTre network as ideal technological solution to improve operational performance managing data flow from power lines’ sensors. The project itself involves the creation and management of a mobile virtual network platform, meaning a private network infrastructure, which will let Terna smoothing communication processes while better managing its infrastructures.

This solution will enable network optimization, forecasting future needs, and implementing predictive maintenance, enhancing Terna’s electrical stations and substations alongside the fiber network. WindTre mobile access service has been further implemented to create a customized solution to meet Company’s specific needs using a hybrid 4/5G network. Terna, which manages power transmission all over Italy, having more than 75.000 kms of high voltage power grids and more than 900 power stations, will benefit from the enhancement of the information flows coming from the distributed sensors on its own lines, developing a digitized and proactive management model using Big Data.

How to implement Italian system’s growth

The Government could definitely boost TLC industry by improving tax reliefs for the so-called “Transizione 5.0”. Nevertheless, Chigi Palace is not currently considering including TLC network infrastructures among the required interventions. New policies supporting demand should focus on SMEs which can’t run complex projects, but which would be involved in the digitalization process.

In Italy small enterprises number around 4 million, representing 95% of business and more than 26% of the added revenue. In the perspective of improving 5G networks’ performance, and considering the increasing demand for mobile connectivity, the development of dedicated indoor coverage is needed. It’s about the so-called DAS, (Distributed Antenna Systems) which improve mobile operators’ signal especially in crowded areas or in places where there is bad signal, like hospitals, museums, shopping centers, stadium, etc.

Distributed Antenna Systems are not only useful as they resort to a multi operators perspective, improving customer experience with mobile radio devices, but also for the development of private networks which would be able to leverage the same coverage infrastructure using dedicated frequencies, as well as public ones, with greater advantages in terms of cost optimization and visual impacts.

Final considerations

Better performance and better safety are among the main reasons encouraging companies to use 5G private networks which seem to be a promising frontier of connectivity for operators working in this field who, however, still must work with fragmented and too limited systems avoiding them from creating an innovative business model. Government and PA’s program of incentives could actually help this field grow but, for now, this solution seems to be a remote hypothesis rather than a concrete opportunity.

Thus, the more realistic scenario is the one where 5G private networks are a niche segment having a high potential for development. We really hope that a concrete measures by Government could boost this model, still not used in our Country.