Mergers and acquisitions are expected to be further implemented in the Telco industry throughout 2024. Alongside the consolidation of mobile operators, network infrastructures industry is radically implementing. As a result of Telecom analysis, in the first weeks of 2024 lots of companies merged: this is the case of Intred which signed a business agreement with Aliedo from which the telecommunications operator will purchase Connecting Italian 100% of social assets; the company primary goal is to develop, implement, deliver and manage telecommunication services and, specifically, mobile and broadband data transmission.

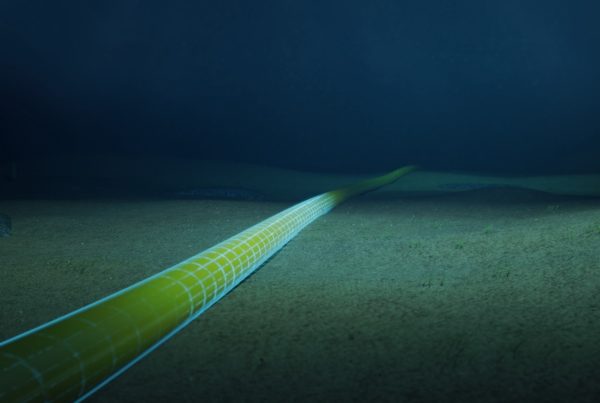

At the end of 2023, Retelit group and BT Italia signed a joint agreement about Retail acquisition of 100% of BT Enia social assets which, since 1999, has been providing services in TLC industry and innovative IT solutions to companies and public administration in Parma, Reggio Emilia and Piacenza. Following this acquisition, Retelit group owns fiber network all over Italy, spanning over 40.000 km, and it has added the Parma data center to its network, which already extends from Bolzano to Bari, for more than 30 data centers, server farms, and Points of Presence (PoP). In the early weeks of the year, the sale of OpNet to Wind Tre was finalized. The company, which owns the former Linkem network, has signed an agreement with Wind Tre for the acquisition of Opnet goods and services. More specifically, Opnet is the first European operator to have implemented a nationwide 5G Stand Alone network and to have advocated for this technology in Italian’s wholesale market. The acquisition has been around 485 million euros.

PWC report and merging in TELCO industry

The merging trend of companies has been reported by a PWC which has shown how, differently from global patterns, Italy registered 26% rise in M&A activities within the technology, media, and telecommunications market in the first months of 2023. This activity was both supported by financial investors (+33%) and corporate investors (+23%).

The growth trend registered in 2018, with a CAGR of 8%, keeps being confirmed. In its report, PWC highlights the most important business agreements from Silver Lake Teamsystem (minor share), Nexi, Paycomet, One Equity Partners, Kirey. The trend of the Italian market, which was later consolidated in the first months of 2024, counterbalances a global trend which registered a decrease of 8% in the first half of 2023, reaching an unprecedented loss since the beginning of COVID19.

Sirti

Sirti

In this scenario, we can find the potential sale of Sirti, company controlled by the Responsible & Sustainable Corporate Turnaround Fund (RSCT) which is managed by Pillarstone financial group working both in Italy and abroad to develop TCL network infrastructures. Sirti works in the TLC and Digital Transformation field while Sirti Telco Infrastructures, part of Sirt Group, is the company providing Service Providers and Infrastructural Players with services aimed to plan, manage, implement TLC networks and sites. More specifically, Sirti is in charge of implementing business plans for the development of ultra-wide band networks.

Sirti Digital Solutions is the Group company specialized in system integration and digital transformation. This company boasts a solid expertise in developing digital transformation projects for the leading operators in the most strategic market fields, like Energy, Finance, Telecommunications, Large Retail, and Public Administration. Furthermore, the company plans, implements, and maintains – with a widespread presence throughout Italy – innovative solutions in IoT, cybersecurity, networking, cloud, data center, and technological systems.

Acquisitions

Before establishing its current internal structure, Sirti engaged in the acquisition and sell of multiple companies. In November 2020, it sold its Transport BU to Mermec S.p.A, a company focused on developing technological solutions to enhance safety within the Gruppo Angel railroad networks. In July 2022, the acquisition of Sirti Energia S.p.A. by the German investment holding company, Mutares, was completed. Subsequently, Mutares established Conexus S.p.A., including the company EXI (formerly part of Ericsson Servizi Italia), previously acquired by Ericsson S.p.A. Concerning acquisitions, in 2019 Sirti purchased 75% of Wellcomm Engineering, emerging cybersecurity company in the Italian market.

Turnaround and positioning in the market

Turnaround and positioning in the market

The Group’s recent accomplishments have notably enhanced its credibility in the market, marking a significant turnaround. In 2020, Sirti ended the fiscal year with a loss of 17 million euros. However, since then, it has worked hard to improve its financial performance. According to the latest figures, in the first half of 2023 Sirti registered 410 million euros of revenues, marking an increase of 18% compared to 348 million euros reported during the same period in 2022 (+62 million euros). The company also reported a further leap in EBITDA, corresponding to +34% compared to the same semester of the previous year, rising from 20.2 million euros in 2022 to the current 27.1 million euros.

Sirti and potential investors

Sirti and potential investors

According to market reports, it seems that a variety of potential buyers, including traditional private equity funds, infrastructure investors, and European strategic operators, may be interested in acquiring Sirit Group. Early indicators suggest that Banca Imi and Goldman Sachs are taking over the sales process as financial advisors. According to data from il Sole24Ore, Chequers Capital and Azzurra Capital, along with operators having subscribers from sovereign funds in the Persian Gulf, are reviewing the dossier. Additionally, there could be a potential interest from Macquarie, an Australian infrastructure group.Top of Form

Among potential strategic investors there would be Circet, French multinational corporation controlled by the US private equity Intermediate Capital Group (Icg); in 2021 it acquired Ceit group, which is headquartered in Chieti and it is among the leading companies in the Italian TLC infrastructure market. The main goal of RSCT is to enhance investments made between 2015 and 2016. It first acquired banks non-performing loans, (like Unicredit and Intesa Sanpaolo) and it later acquired the entire Group from industrial partners (including Techint and Stella Jones), from BI-Invest (the holding company of the Bonomi family), from the private equity funds Clessidra and 21 Investimenti, from the debt funds Ver Capital and Emisys Capital, and from Banca IMI.

Italian Government preventive measure with the Golden Power

Italian Government preventive measure with the Golden Power

When talking about company’s transfer, the Italian Government could opt for the so-called Golden Power to prevent a potential sale to a foreign investment fund, which is something desired considering Sirti positioning in our country. According to MF-Milano Finanza, Palazzo Chigi could exercise its veto power to make sure that Sirt’s assets, workforce and know-how keep being safeguarded. The Meloni administration has previously resorted to the Golder Power on multiple occasions. In November of last year, it employed it to block the sale of the former Microtecnica, an Italian-based mechanical company fully controlled by U.S.-based Collins Aerospace and French company Safran. Then, in June 2023, it was employed to restrict Chinese shareholders’ involvement in Pirelli and protect the technological assets of the company, particularly their pneumatic sensor technology used for data collection.

Much was discussed last December about the use of the Golden Power to prevent the sale of Rosetti Marino, an Italian company headquartered in Ravenna specialized in dockyard and offshore platforms, to a foreign company managed by Indian company Larsen & Toubro, Malaysian firm Bumi Armada, or South Korean company Daewoo E&C. To better understand the reason behind the government’s decision, it’s important to highlight that Sirti digital solutions, a technology firm providing digital and cybersecurity services, was recently chosen to construct a new data center infrastructure at the NATO Joint Force Command in Naples.

Final thoughts

Telco implementation in the merging and acquisition process shows that the Italian market services (Fastweb-Vodafone recent merge) and infrastructures are about to change. As shown by the acquisitions in the first months of 2024, the delay in our market is prompting speculation about a potential consolidation. In addition to Sirti, other dossiers remain opened: It is the case of the possible sale of the WindTre network, whose transfer to the Swedish fund EQT fell through a few weeks ago but has not yet been completely ruled out. Similarly, concerning operators, after Fastweb-Vodafone merging, the future of Iliad is being discussed. The company had also tried to acquire Vodafone’s Italian assets and now it finds itself working as a standalone operator in the domestic market.