Most telco investments in 5G network are driven by cost saving.

Telco companies have built their success so far almost entirely on outdoor networks, because, in the 2G and 3G days, most mobile usage took place outside houses. When 4G ushered in real demand for large amounts of mobile data, people started to use their mobile devices in their homes and offices instead of landlines, bringing out the inadequacy of the outdoor-in model.

The greatest number of mobile network operators (MNOs) have struggled to find new solutions, since 5G technology needs a high-quality service within buildings as well as outside them.

To deploy 5G network, in most cases, mobile operators have effectively launched “4G-plus” – using a 5G New Radio (NR)* on the same LTE sites, but with more sophisticated MIMO antennas: indeed, not the true 5G. Whilst this solution has boosted both network performance and its commercialization, it is clear that this is a temporary solution which will last only few years before facing the real challenges of a 5G migration.

Other trends, like densification of the cells and virtualization, will arrive later.

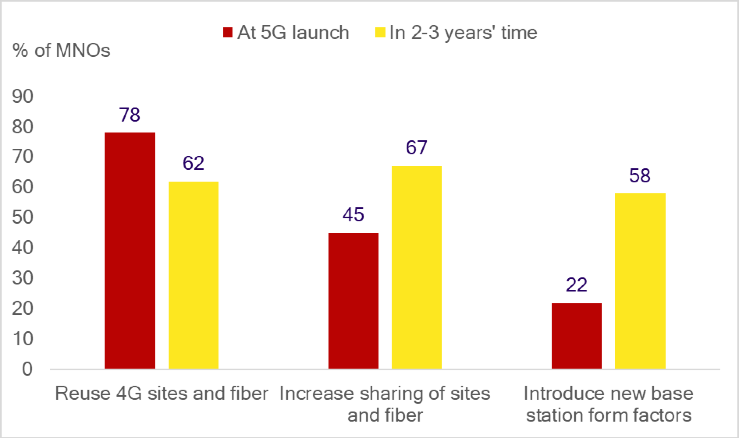

To prove this thesis, Rethink Technology Research, which is a company of analysis, has examined three ways in which MNOs are looking to invest in 5G macro networks:

- Leveraging existing 4G assets, such as sites and the core, as much as possible in the 5G launch;

- Planning for increased levels of sharing of assets such as sites, fiber and even active RAN;

- New base station form factors, notably the “mini-macro”, which will improve urban coverage and capacity outdoors.

78 mobile operators were asked to name all the tactics which would help to achieve cost-efficient 5G outdoor RAN and these were the three most commonly cited. The 78% of MNOs will reuse 4G sites and fiber when launching 5G, while the 62% will do the same in the next two or three years. It is expected the adoption of the tactic of increasing sharing assets for the 45% of MNOs and the 67% of them will do this in the next two or three years.

Moreover, the realization of new base stations is a priority only for the 22% of telco companies, while the 58% of mobile operators will take measures in this respect in the next two or three years.

Today, telco companies are planning to share assets, reducing costs and expenses, also because the average revenue per user (ARPU) of the mobile broad band has hit an all-time high.

Maria Vittoria Seu

MCO

LUBEA s.r.l.

*5G NR is the new radio access technology for the next generation mobile communication standard.